The energy industry’s most influential conference, CERAWeek 2025, is in full swing, bringing together leaders from across the sector to discuss pressing challenges, investment trends, and the future of energy policy. From investment surges to infrastructure bottlenecks and geopolitical tensions, here are the key takeaways from today’s discussions in Houston.

Investment Surge: U.S. Energy Sector Gains Global Interest

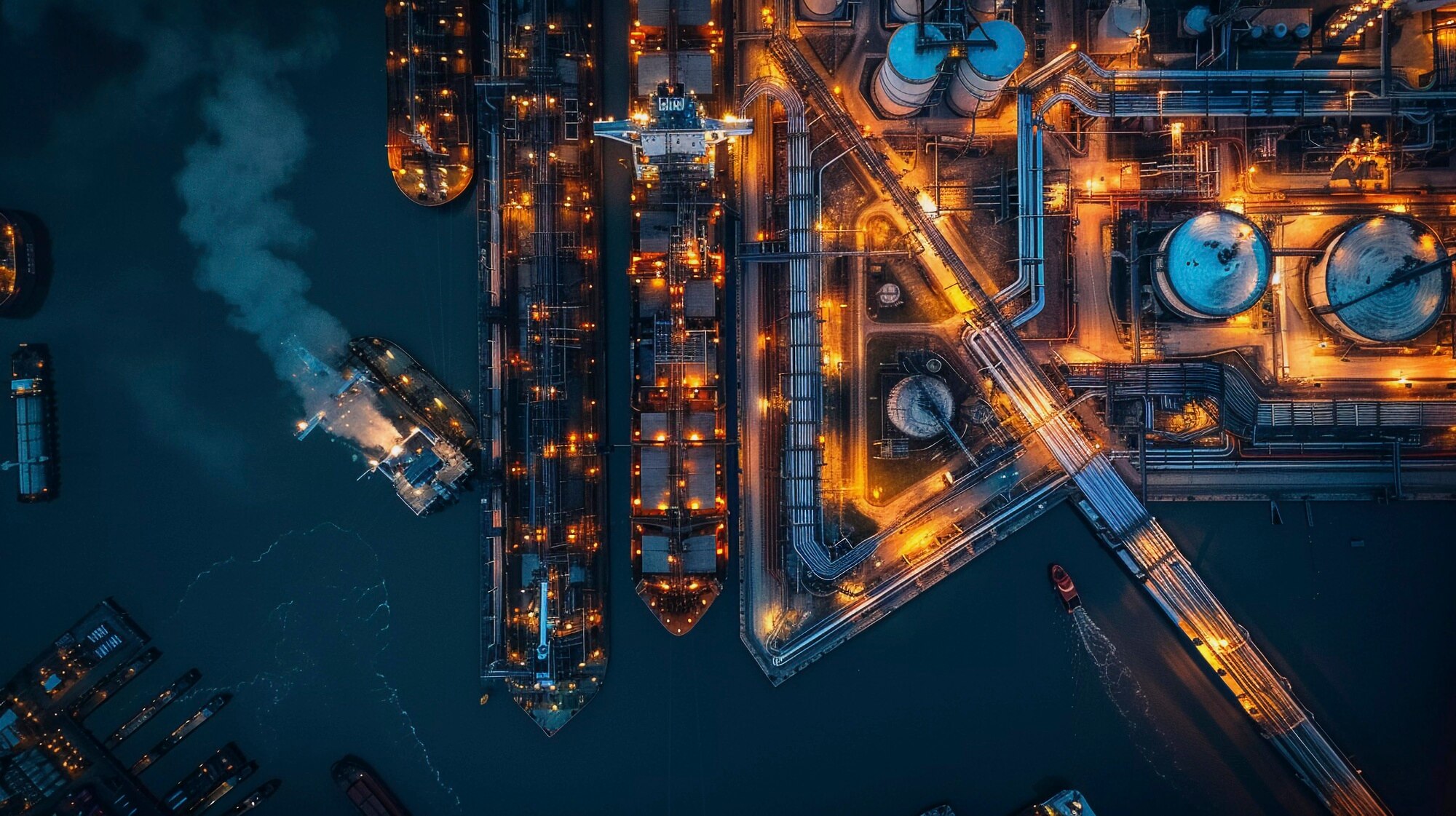

Despite ongoing trade disruptions, foreign investment in the U.S. energy sector remains robust. Industry leaders are applauding President Donald Trump’s energy dominance agenda, which prioritizes deregulation and fossil fuel expansion. Executives see this as a key driver for increased investment in natural gas and infrastructure projects.

“We’ve got probably the best energy team in the United States we’ve had in decades.”

— Ryan Lance, Chairman & CEO, ConocoPhillips

Infrastructure Bottlenecks: The Permitting Problem

With U.S. power demand soaring, especially from data centers and AI-driven industries, energy executives are urging policymakers to streamline permitting processes. Delays in approvals are seen as the biggest hurdle to meeting America’s rising energy needs, with many calling for immediate reforms.

Canada-U.S. Tensions: Rethinking Oil Exports

Canada is reevaluating its trade strategy in response to Trump’s trade policies, including potential restrictions on oil exports to the U.S. As energy ties become increasingly strained, Canadian officials are pushing for greater diversification to reduce reliance on American markets.

“Canada needs to think strategically about how to diversify our trade away from dependence on the United States.”

— Jonathan Wilkinson, Minister of Energy and Natural Resources, Canada

Market Outlook: Peak U.S. Oil Production and Natural Gas Growth

Industry forecasts indicate that U.S. oil production will peak between 2027 and 2030, after which output is expected to decline. Meanwhile, natural gas demand is projected to grow at 2% annually for the next 15 years, as AI-driven power needs fuel investment in gas infrastructure.

“We actually see a peak of U.S. production within the next five years or so. After that, some decline.”

— Vicki Hollub, President & CEO, Occidental Petroleum

Energy Realism: Balancing Fossil Fuels and Renewables

Executives are embracing a pragmatic approach to energy security, emphasizing the ongoing role of fossil fuels alongside renewables. However, carbon capture and hydrogen are struggling due to high costs and regulatory uncertainty.

AI-Driven Power Demand and the Role of Natural Gas

With AI and tech sectors demanding ever more electricity, companies like Microsoft are exploring natural gas-powered data centers with carbon capture. The AI revolution is reshaping energy consumption, pushing policymakers and investors to rethink long-term strategies.

“The U.S. needs to generate far more electricity to power data centers and lead in AI.”

— CERAWeek Panel Discussion

Looking Ahead: What’s Next for the Energy Industry?

The energy sector stands at a critical juncture. With rising investments, policy shifts, and technological advancements, the next decade will define the global energy landscape. As CERAWeek 2025 continues, industry leaders are navigating the balance between pragmatism and innovation, ensuring that energy security and sustainability move forward hand in hand.

Stay tuned for more updates from CERAWeek 2025 as the conversation continues to shape the future of global energy.